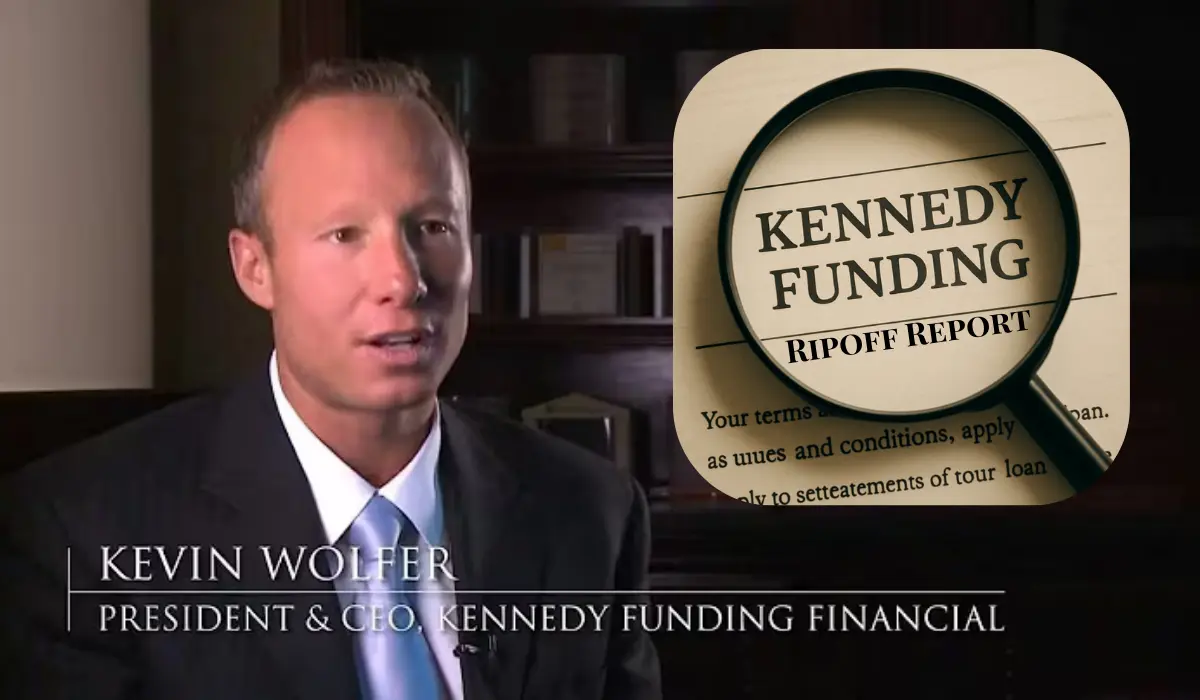

Kennedy Funding has attracted significant attention through ripoff reports and borrower complaints posted across consumer platforms. The New Jersey-based private lender specializes in bridge loans and commercial real estate financing, serving clients who cannot obtain traditional bank funding. Understanding both sides of these allegations helps potential borrowers make informed decisions.

The company operates in a high-risk lending sector, providing quick financing solutions for properties facing foreclosure, bankruptcy, or other complications. Since its founding in 1987, Kennedy Funding claims over four billion dollars in closed loans across multiple countries. However, numerous complaints have emerged regarding their business practices.

Common grievances include hidden fees that were not clearly disclosed initially, creating unexpected expenses for borrowers. Many clients report discovering additional costs only after signing agreements, feeling misled about the true financial obligations. These surprise charges have become a recurring theme in consumer complaints.

Communication issues represent another major complaint, with borrowers claiming they received slow responses or struggled to reach loan officers after paying upfront fees. Some clients describe feeling abandoned during critical stages of their financing process, unable to get timely updates on loan status.

Upfront fees reportedly reach as high as ten thousand dollars, with concerns about unclear contract clauses relating to refundability and approval contingencies. The lack of transparency regarding these terms has frustrated borrowers who expected clearer documentation before committing funds.

Legal cases have involved allegations of mishandling loan agreements, with accusations described as deceptive practices. Several lawsuits have centered on miscommunication about actual loan costs and interest rates, though most disputes involve contract disagreements rather than proven fraud.

Kennedy Funding is not accredited by the Better Business Bureau, though this does not necessarily indicate wrongdoing. The company has responded to complaints by improving communication practices and attempting to clarify loan terms more effectively.

Kennedy Funding maintains that most complaints stem from misunderstandings about private lending, which differs significantly from traditional banking. They emphasize that all terms appear in contracts and encourage thorough review before signing. The company operates legally within United States lending regulations and continues announcing new loan closings.

For potential borrowers, due diligence remains essential. Research reviews across multiple platforms, verify all fees in writing, and consult financial advisors before committing. Compare offerings from different lenders regarding interest rates and closing timelines. Request clear documentation about refund policies for upfront fees.

Understanding private lending complexities helps prevent disputes. These loans typically involve higher costs due to increased risk, serving clients traditional banks reject. While legitimate grievances exist, context matters when evaluating online complaints in this specialized lending sector.